The Federal Reserve (Fed) is preparing to take a significant step toward lowering borrowing costs at its upcoming two-day policy meeting, set to conclude on Wednesday. After a period of rapid interest rate hikes to combat rising inflation, the central bank is now shifting gears. Its benchmark interest rate is currently between 5.25% and 5.5%, the highest in over two decades, but the Fed is expected to make a cut. The primary objective: to support a robust labor market as inflationary pressures have eased. However, the magnitude of the rate cut remains in doubt, with Fed Chair Jerome Powell and his colleagues having to weigh various economic factors carefully.

The market is eagerly anticipating this move, as lowering interest rates could have broad implications for consumers, businesses, and investors. Rate cuts tend to make borrowing cheaper, fueling spending and investment. The size of the cut, whether a traditional quarter-point reduction or a more aggressive half-point, will send a strong signal about the central bank’s outlook on economic risks and future growth.

Why the Fed is Considering a Rate Cut

The Fed has been on a path of monetary tightening over the past two years, raising interest rates to control rising inflation. The post-pandemic economic recovery saw supply chain disruptions and pent-up consumer demand, which contributed to a surge in inflation in 2021 and 2022. To bring inflation down, the Fed responded with a series of rapid rate hikes, pushing its benchmark rate to multi-decade highs.

However, recent economic data indicates that inflationary pressures are easing. According to the latest Consumer Price Index (CPI) data, inflation has moderated and is moving closer to the Fed’s 2% target, although certain sectors like housing and energy remain outliers. With inflation subsiding, the Fed now has more room to cut interest rates without risking a resurgence of price increases.

At the same time, the U.S. labor market remains strong, with low unemployment and steady job creation. However, there are growing concerns that if rates remain high for too long, it could start to weigh on economic growth and eventually lead to job losses. A rate cut would help ease financial conditions, giving businesses and consumers a reprieve from rising borrowing costs, which have already slowed housing and business investment.

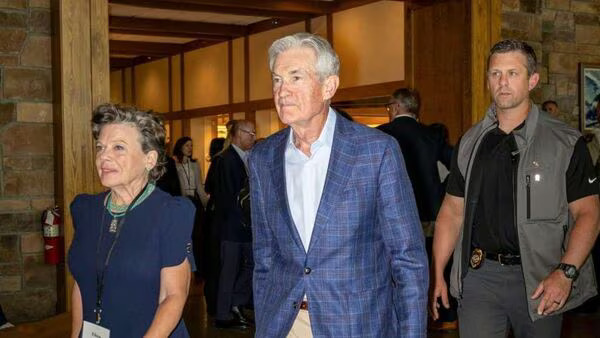

The Delicate Balance Facing Jerome Powell

Fed Chair Jerome Powell faces a critical decision on the size of the rate cut. Should the Fed opt for a modest quarter-point reduction, it would be seen as a cautious approach, signaling that the central bank is carefully monitoring inflation risks while offering some relief to the economy. A quarter-point cut would bring the federal funds rate to a range of 5.0% to 5.25%, still high by historical standards but lower than its current peak.

Alternatively, a larger half-point cut would reflect deeper concerns about the economic outlook. Such a move would suggest that the Fed is prioritizing growth and willing to act aggressively to ward off any potential downturn in the labor market. A half-point cut would reduce the federal funds rate to 4.75% to 5.0%, providing a larger boost to the economy but potentially raising concerns that inflation could reignite if economic activity picks up too quickly.

The decision hinges on several factors, including the Fed’s inflation outlook, the health of the labor market, and global economic conditions. Powell will need to carefully communicate the rationale behind the rate cut, particularly during his post-meeting press conference, to avoid sending mixed signals to financial markets. His remarks will be closely scrutinized for clues about the Fed’s future policy trajectory, including whether more cuts are on the horizon or if this is a one-time adjustment.

Economic Risks and the Case for Caution

While inflation has shown signs of cooling, other economic indicators suggest the Fed should remain cautious about cutting rates too aggressively. One key area of concern is the impact of high interest rates on consumer spending and business investment, both of which have been dampened by the Fed’s recent rate hikes.

In the housing market, for instance, mortgage rates have soared, leading to a slowdown in home sales and construction. This has ripple effects across the economy, as the housing sector is a major driver of consumer spending and job creation. Similarly, businesses are facing higher financing costs, which could limit their ability to invest in new projects, hire workers, and expand production. A prolonged period of high rates could eventually weigh on growth, making a rate cut more urgent.

In addition to domestic factors, the global economic environment remains fragile. China’s economy is still grappling with the aftereffects of its zero-COVID policies and a slowdown in key sectors like real estate. Europe, too, faces economic challenges, including elevated energy prices and sluggish industrial output. These global headwinds could spill over into the U.S. economy, further justifying a rate cut to cushion against potential shocks.

Despite these risks, the Fed must also be mindful of the possibility that inflation could reaccelerate. Supply chain disruptions, wage pressures, or a sharp rebound in demand could all push prices higher once again. If inflation were to pick up, the Fed could be forced to hike rates again, potentially undermining its credibility and destabilizing financial markets.

Market Reactions and Expectations

Investors and financial markets are closely watching the Fed’s decision. A rate cut of any size is likely to be welcomed by the markets, as lower borrowing costs typically boost stock prices, lower bond yields, and encourage investment. However, the size of the cut will determine the market’s response.

A quarter-point cut would likely be seen as a moderate move, suggesting that the Fed is cautiously optimistic about the economy while remaining vigilant about inflation risks. Markets would likely react positively, but the impact might be limited, as many investors have already priced in expectations of a smaller cut.

In contrast, a half-point cut could spark a more dramatic market response. Such a move would signal that the Fed is more concerned about the risk of an economic slowdown and is willing to act aggressively to support growth. Stock markets could rally sharply, while bond yields could fall as investors anticipate a more accommodative monetary environment in the months ahead.

However, the Fed’s actions could also lead to increased market volatility, especially if Powell’s comments suggest uncertainty about future rate cuts. If the Fed signals that further cuts may be necessary, markets could interpret this as a sign that the central bank is more concerned about the economy than previously thought. Conversely, if Powell emphasizes the need for caution and suggests that additional cuts are unlikely, markets could react negatively.

What Comes Next for the Fed?

The size of the Fed’s initial rate cut will set the tone for its future policy decisions. A quarter-point cut could signal that the central bank is taking a wait-and-see approach, leaving the door open for further cuts depending on future economic data. A half-point cut, on the other hand, would suggest that the Fed is more committed to stimulating growth and could lead to a series of cuts in the coming months.

The Fed’s actions will also be guided by upcoming economic data, including inflation reports, job market figures, and consumer spending trends. If inflation remains subdued and the labor market holds steady, the Fed may pause after this initial cut. However, if the economic outlook worsens or inflation resurfaces, the central bank could be forced to adjust its policy stance.

Ultimately, the Fed’s challenge is to navigate an uncertain economic landscape while balancing the risks of inflation and growth. As it prepares to lower rates, the central question remains: how far is it willing to go to support the economy without stoking inflationary pressures? The answer to that question will shape the course of U.S. monetary policy and influence global markets in the months ahead.

Disclaimer: The thoughts and opinions stated in this article are solely those of the author and do not necessarily reflect the views or positions of any entities represented and we recommend referring to more recent and reliable sources for up-to-date information.